ASC 606, Revenue From Contracts With Customers, is the newest revenue recognition standard issued by FASB and IASB. The new standard provides a five-step model for recognizing revenue from customer contracts. This blog outlines the first step, Identifying the Contract with the customer, and demonstrates how to complete step 1 for the three common contract types.

What is a Contract?

The new revenue guidance defines a contract as an agreement between two or more parties that creates enforceable rights and obligations. The essential parts of a contract include the following:

- All parties have approved the agreement – Contracts may be written, oral, or implied by an entity’s standard business practices. Contract enforceability is a matter of law; as such, an entity should consider the legal jurisdiction in which it operates as the rules for contract enforceability.

- All parties are committed to fulfilling their obligations – If each party has the unilateral right to terminate a wholly unperformed obligation, then the standards state that no contract exists. Therefore, this criterion addresses termination clauses.

- Each party’s rights are identifiable – The agreement must identify the goods and services to be provided. If this cannot be accomplished, there is no way to determine when a transfer of control has occurred, which is a prerequisite for recognizing revenue.

- The contract has commercial substance –This means that an agreement can only exist if the risk to the customer, timing of the delivery of goods/services, or the number of cash flows to an entity are expected to change as a direct result of the contract.

- Collectability is probable – the new standard requires vendors to evaluate a customer’s credit risk at the contract’s inception. As a result, revenue can only be recognized when payment is likely to be received.

Other Considerations for Revenue Recognition:

Payment for Agreement with No Contract

When payment is received for an agreement that does not qualify as a contract, the vendor can only recognize revenue when one of two events occurs. Either the agreement has been terminated and the payment received is not refundable, or the vendor does not owe any goods or services to the customer. All of the transaction prices have been received and are not refundable.

To illustrate: A developer enters into a contract to sell a building to a customer who plans to open a retail shop. The developer receives a non-refundable deposit from the customer. The remaining amount owed will be paid over time from the shop’s revenues. There is a significant risk that the remaining amount will be collected, so a contract does not exist according to the standard. The upfront deposit cannot be recognized as revenue until the entire remaining amount owed is substantially received, or the shop closes, and the contract is terminated.

Combining Contracts

If multiple contracts with the same vendor are entered into at or near the same time and meet at least one of the following criteria, the standards require the vendor to combine the contracts into one contract.

- Contracts are negotiated as a single package with one business objective.

- The payment amount for one contract depends on the other contract’s performance.

- At least some of the promised goods or services in the contracts are a single performance obligation.

ASC 606 allows vendors to use the portfolio method of contract combination, permitting vendors to combine contracts that would otherwise not be connected to simplify the revenue recognition process. However, this method will only be allowed if the result is not materially different from accounting for each contract individually.

Contract Modifications

Parties to a contract may change the transaction price and scope of the contract. Depending upon circumstances, these changes may be accounted for as a separate contract or as a modification to the existing contract. The final part of this series will address contract modifications in more detail.

CASE STUDIES

To demonstrate how to effectively use Oracle EBS Projects to drive compliance with ASC 606 Revenue Recognition standards, the following case studies will be presented for each step outlined in the new revenue standard.

Case Study 1: Service Contracts based on selling hours (T&E)

Service Contracts based on selling hours (Time & Expense-“T&E” ): In this scenario, the delivery organization contracts to provide a specified number of hours of specialized resources, which will deliver to the client’s requirements. There are no specific deliverables listed in the contract. These contracts are slowly disappearing as clients demand more specifics before signing contracts. These contracts are often used in Pure Professional Service Organizations (“PSO”) in Management Consulting.

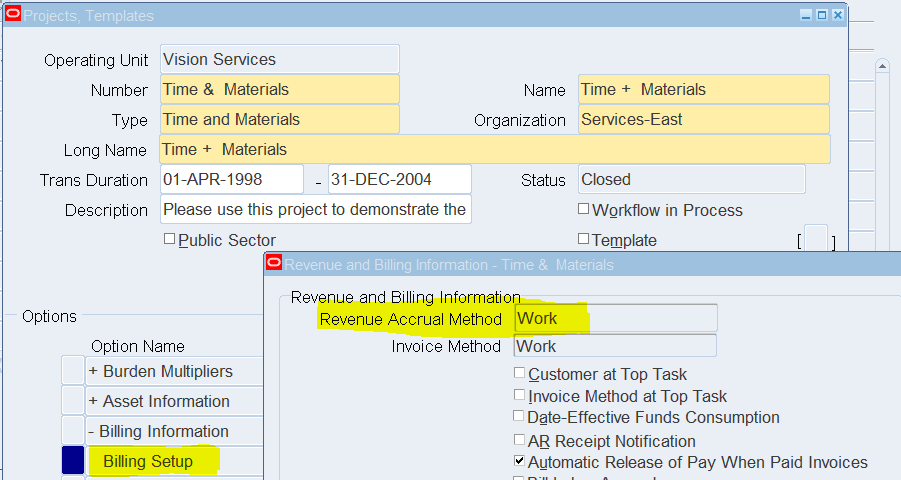

For service contracted based on time & expense billing, the Project would be set up as shown below.

Work-Based Revenue Recognition – Accrues revenue as work occurs.

Case Study 2: Service Contracts based on Deliverables / Milestones

Time & Material (“T&M”) Service Contracts based on specific Deliverables AND Fixed Price Service Contracts based on Milestones are very typical. They are combined here even though they have completely different billing methods because they will need to be treated the same for revenue recognition purposes under the new standard. Additional contract types like Cost Plus or some variant of this with different fees will also fall under this category for Revenue Recognition as long as these contracts specify specific obligations/deliverables on the service provider. PSOs, Engineering, IT Services, and Marketing/Advt commonly use these contracts. Services organizations.

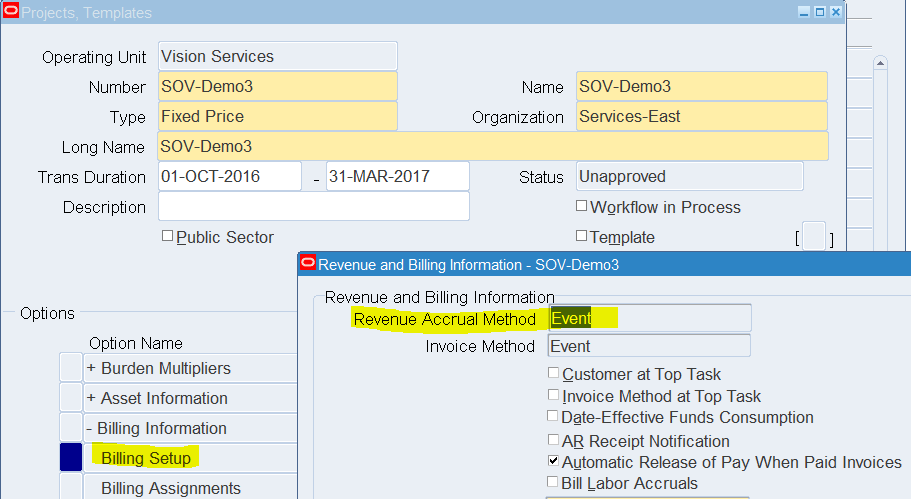

For Contacts based on specific Deliverables or Fixed Price Contracts based on Milestones, the Projects will be set up as follows:

Event-Based Revenue Recognition – Accrues revenue and bills based on events.

Case Study 3: Unit Price-Based Contracts

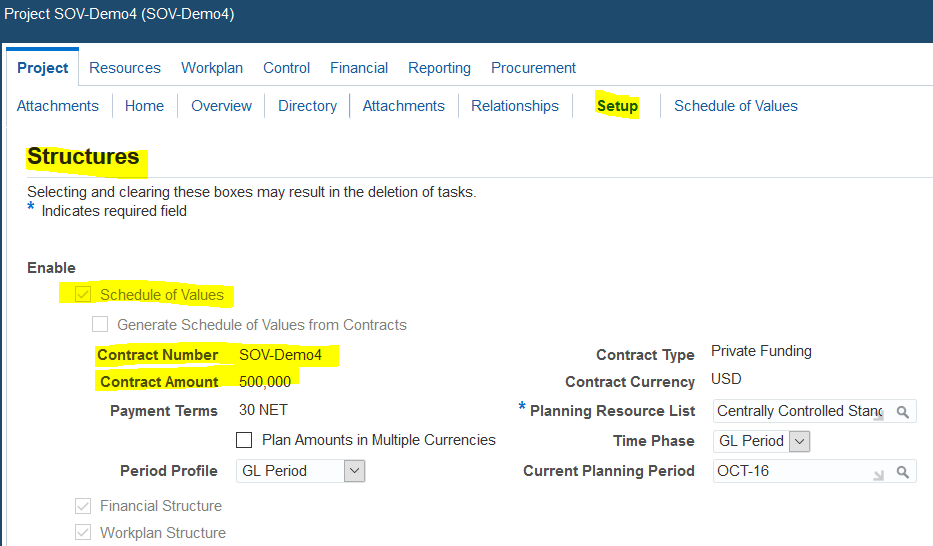

Unit Price-Based Contracts: Also referred to as Schedule of Values (SOV) contracts. These contracts typically specify the number of units to be delivered for one or more types of items after an initial design/confirmation period. Construction commonly uses these contracts and ATO/ETO-based Manufacturing Firms.

- SOV functionality is introduced in release 12.2.5

For Contacts based on Unit Price, the Projects will be set up as follows:

Schedule of Values Enabled Project – Accrues revenue based upon events defined in a Schedule of Values.

As you can see, Oracle Projects allows you to configure your projects to meet the requirements of Step 1 of the new ASC 606 guideline with standard functionality. The following blog in the series will cover step 2, Identifying the Performance Obligations in the contract.

Oracle Licensing Requirements

- Project Costing and Billing are required for all features discussed in this paper.

- The schedule of Values functions is available in Oracle Project Planning and Control release 12.2.5.

Our Revenue Recognition Standards blog series will demonstrate how project-centric companies can use Oracle EBS Projects to manage and comply with the new standards with minimum disruption to existing business practices.

Up next – Step 2: Identify Performance Obligations in the Contract – Revenue Recognition Standards

Learn More on managing ASC 606 revenue recognition with Oracle EBS Projects-

Read the white paper

View the presentation