Part 2 of 2

LEVERAGING ORACLE PROJECTS TO MANAGE PERFORMANCE-BASED REVENUE

As stated previously, the core principle in the new Standard requires that an entity recognize revenue to depict the transfer of goods or services to a customer in an amount that reflects the consideration given in exchange for those goods or services.

Impact on Balance Sheet and Income Statement

When a contract is signed, an asset and a liability are created for the goods and services promised to the customer.

Upon fulfilling an identifiable performance obligation (commonly referred to as a “deliverable”), the liability is reduced, and revenue is recognized when the customer satisfies that performance obligation.

The asset is reduced when payment is received for the goods and services.

This new methodology differs from the previous generally accepted practice of recognizing revenue when the customer is billed and a receivable is created. No longer will a company track unbilled revenue streams.  Oracle Projects allows you to configure your projects to meet the requirements of Step 5 of the new ASC 606 guideline with standard functionality.

Oracle Projects allows you to configure your projects to meet the requirements of Step 5 of the new ASC 606 guideline with standard functionality.

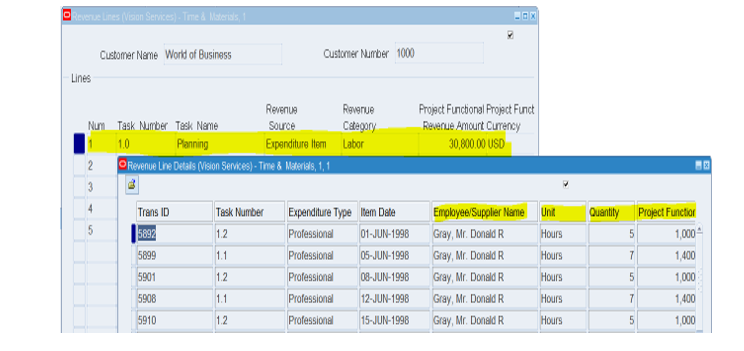

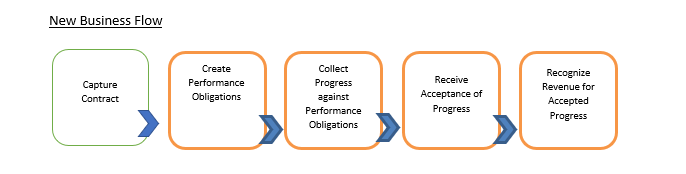

Step 5 of the Standard requires a two-step approach. Using Oracle Projects, work is performed, and delivery is recorded. Then, a process to Generate Draft Revenue for the projects is run to complete the recognition process.

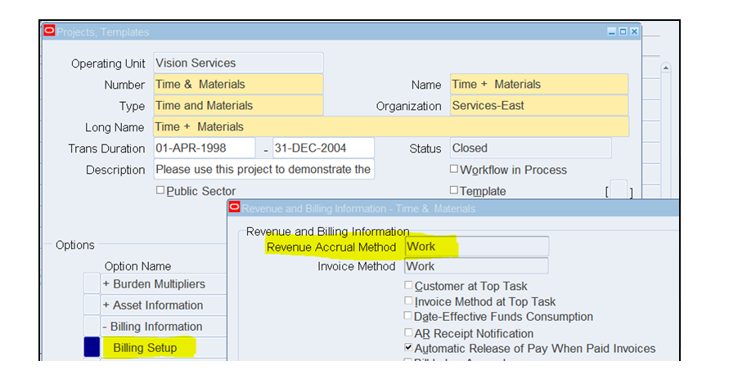

The following is an example of how your company can leverage Oracle Projects to meet ASC 606 compliance.

Service Contracts based on selling hours (T&E)

- Work-Based Revenue Recognition

- Standard Oracle functionality of Time & Expense Billing

- Set up project and billing information

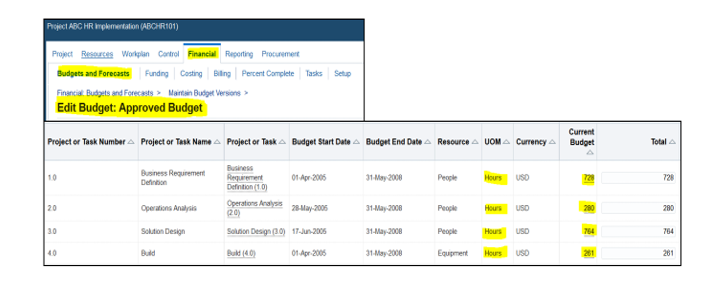

- Identify the Performance Obligations and set up Budget Lines for the contracted hours.

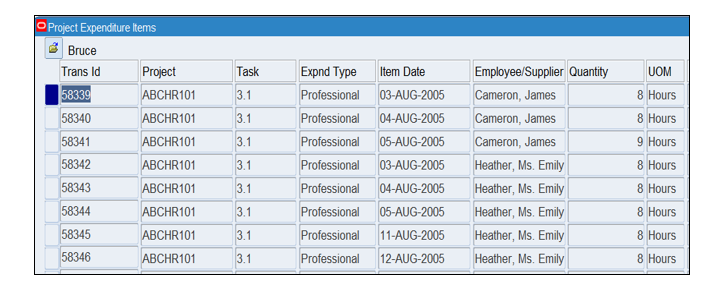

- Delivery Team Charges Time & Expenses to the Project

- Revenue is based on hours charged.

- Acceptance of work performed implicitly when the customer signs the timecard.

- Invoicing takes place when the timecard is approved. This process can precede the actual. recognition of revenue as the performance obligation is not yet complete.

- As each phase of the project is finished, revenue is recognized.

Run the Generate Draft Revenue Process for your projects to recognize revenue

Perform Work and Record Delivery

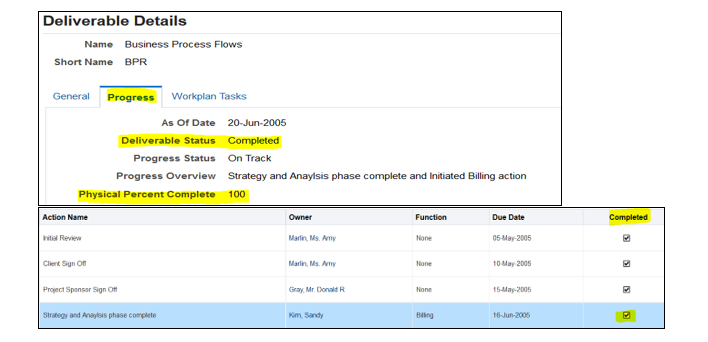

- T&M Service Contracts based on specific Deliverables

- Fixed Price Service Contracts based on Milestones

- Mark the Deliverable as Complete. Mark Billing Action as Complete

Run the Generate Draft Revenue Process for your projects to recognize revenue:

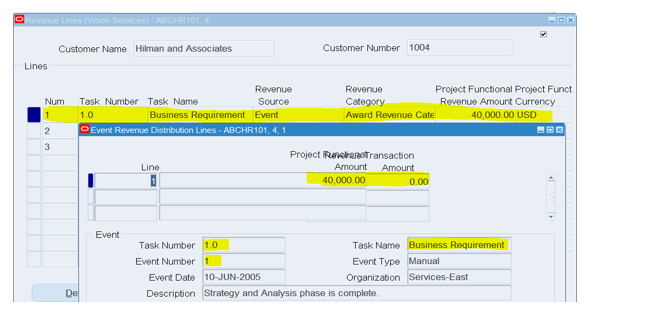

T&M/Fixed Price Service Contracts

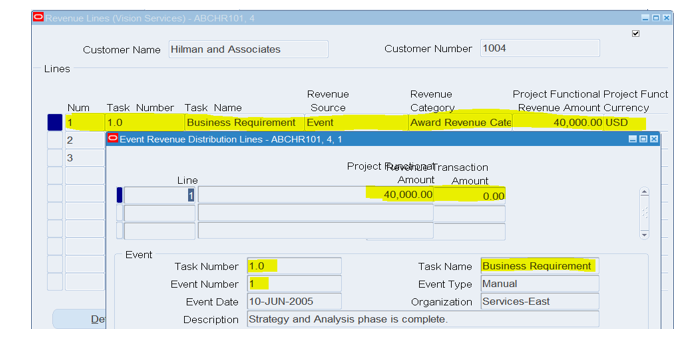

- A Fixed Price Service Contract requires using Billing Events generated from deliverables to generate revenue.

- Invoicing can be generated per the terms of the contract; however, revenue cannot be recognized until the performance obligation has been met.

Unit Price-Based Contracts

Oracle Planning and Control can utilize a Schedule of Values structure (“SOV”). The SOV allocates value for various work parts from a contractual agreement. The SOV schedule is also used as the basis for monitoring progress, tracking deliverables, and submitting and reviewing payment certificates for billing the client. The user can either enter a contract in Oracle Project Contracts or directly enter one. Once a project is created, it can be updated from Oracle Project Contracts or entered in Oracle Planning and Control.

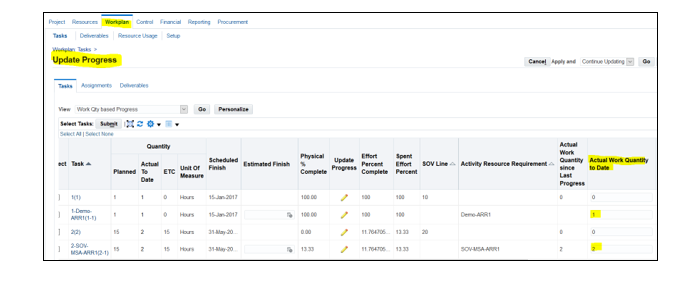

- Enter Progress and record the quantity completed for each SOV Task

- In this case, a task has been set up for each performance obligation under the contract. As the task is completed and accepted, revenue can be taken

- Billing Events are generated from the Schedule Of Values progress and are used to generate revenue

Recent Enhancements to Support ASC 606

Oracle has been supporting organizations implementing these changes in their business to accommodate the new Standard. New consolidated patch sets to Oracle Projects have been released to aid in implementing and managing project revenue according to the new accounting standards.

For companies using Oracle EBS Projects Suite Release 12.1.3 and above and Release 12.2.7 and above, Oracle has issued a patch specific to each release to support project revenue management according to ASC 606.

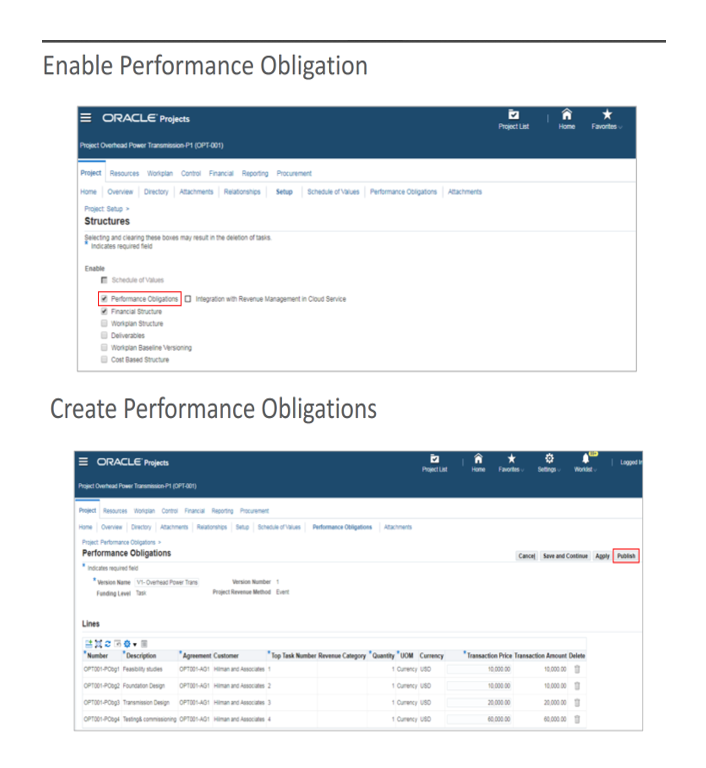

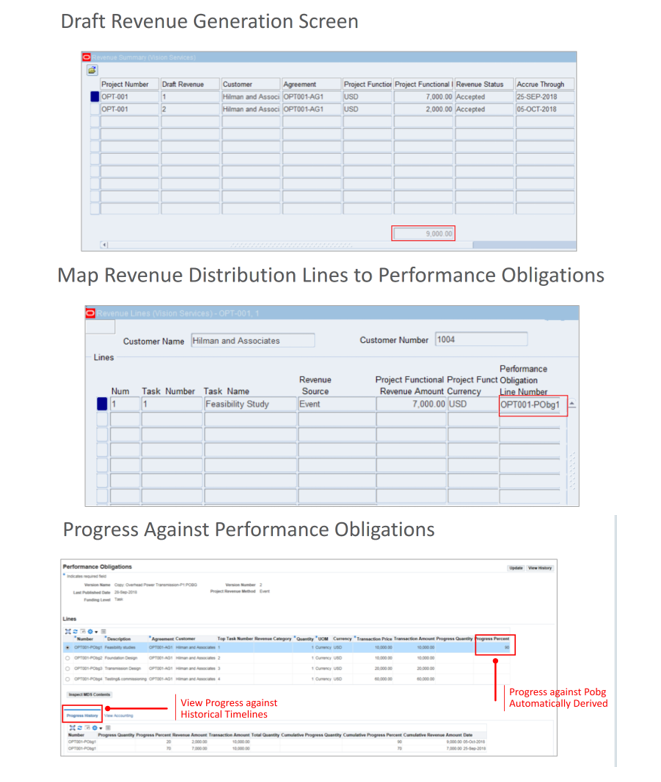

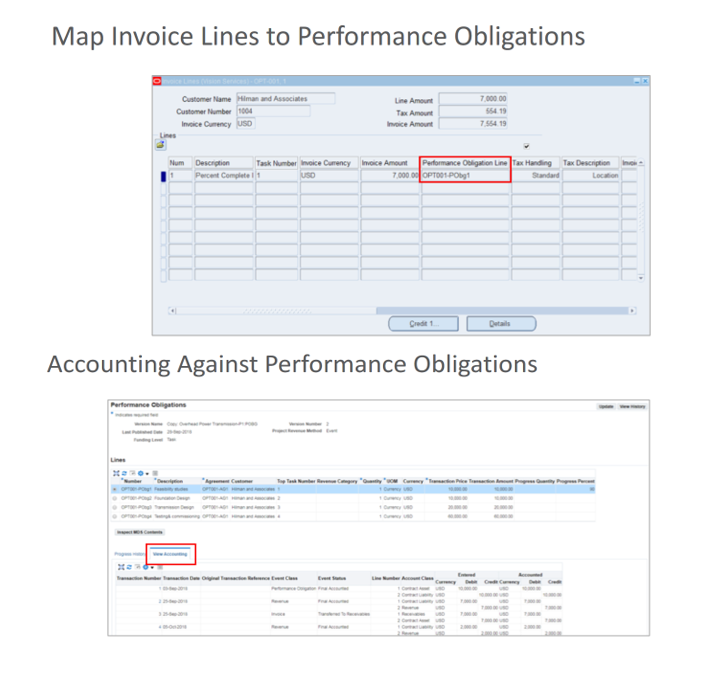

Below you will find screenshots of some of the new standard functionality available with these changes, recently published by Oracle. As you can see, Oracle Projects addresses setup, tracking, and revenue recognition via a new Structure for Performance Obligations.

The new processes allow the user to enable the use of Performance Obligations, create said obligations, publish and track progress against the performance obligation and generate revenue in accordance with the new standards.

As you can see, Oracle Projects allows you to configure your projects to meet the requirements of the new ASC 606 guideline with standard functionality.

Oracle Licensing Requirements

- Project Costing and Billing are required for all features discussed in this paper.

- Project Planning and Control (formerly known as Project Management) must be implemented to leverage Deliverable functionality.

- Schedule of Values functions are available in Oracle Project Planning and Control release 12.2.5

- Application of Patch sets as described in this paper to take advantage of the ability to record and track Performance Obligations

Contract modifications, commonly referred to as change orders or amendments, occur when the price or scope of a contract is changed. Depending on the circumstances, these changes are accounted for either as a modification to an existing contract or a separate one. Proper accounting treatment for modifications differs based on this determination.

There are three steps to determine the proper treatment for a contract modification.

Determine Whether the Change Qualifies as a Contract Modification – A contract modification is any change to enforceable rights and obligations of the parties to the original contract. The Standards define this as a change in the original contract’s scope and/or price. It does not need to be written, it can also be oral or implied through customary business practices. Once an entity determines whether a change is a contract modification, it determines whether to account for it as a change to the original contract or as a separate contract.

Determine Whether the Modification is a Separate Contract – To determine that a modification is a separate contract, these two criteria must be met.

- The scope of the contract has increased with the addition of distinct goods or services, and

- The contract price increased by an amount comparable to the entity’s standalone selling price of the additional goods or services. (Selling price less ordinary selling costs)

Determine the Proper Accounting Treatment for Contract Modifications – If a contract modification is considered a separate contract, no changes to the existing revenue on the original contract are required. The new contract is recognized as the performance obligations in the new, separate contract are met. However, if the contract modification is not considered separate, then the modification is combined with the original contract. Two methods are defined in the Standard for proper revenue recognition of a combined contract modification.

- Prospective Treatment

If the remaining goods/services are distinct from those of the original contract and do not meet the criteria for a separate contract, the entity treats the original contract as terminated and accounts for both the original contract and modifications together as a newly created contract (ASC 606-10-25-13).

Revenue already recognized on the original contract is not adjusted. All remaining transactions are accounted for on a prospective basis.

- Cumulative Catch-up Adjustment

If the remaining goods/services are not distinct, the entity combines the increase or decrease of goods or services with the original contract’s promised goods/services to create a single performance obligation that is partially completed at the modification date. The entity must adjust previously recognized revenue to reflect the changes of the modification to the transaction price.

USING ORACLE PROJECTS TO MEET THE OBJECTIVES OF CONTRACT MODIFICATIONS AS DEFINED

IN ASC 606

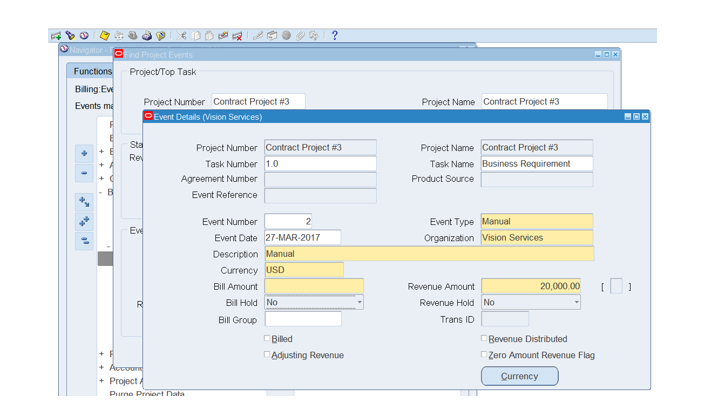

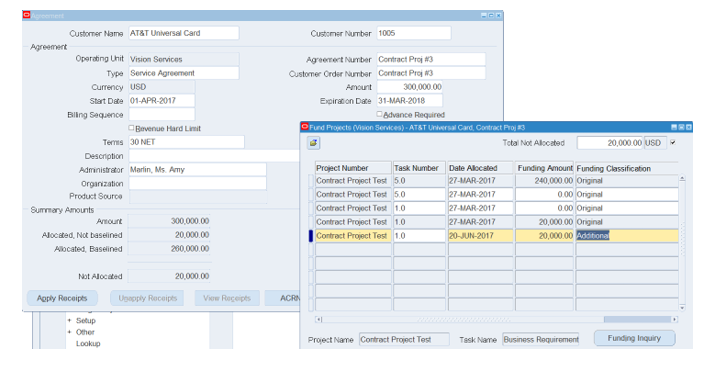

Begin by increasing the amount of the Agreement on the project, then adding a funding line for the increased contract amount to the project tasks.

If the contract modification is Prospective, the Date Allocated should reflect the date from which revenue recognition will occur.

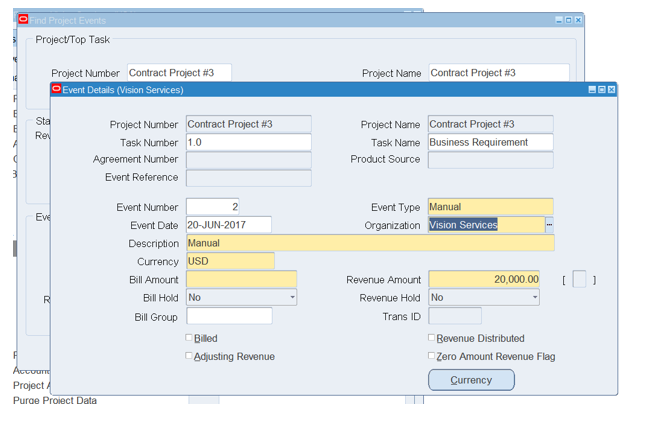

Create a Revenue Event using the new Date Allocated and run revenue generation processes. As indicated, the new revenue amount will begin as of the new date.

If the contract modification is cumulative, the Additional funding should be entered with the original Allocated Date. When a new Revenue Event is created, use an event date that is retroactive to the original date.

The new revenue will “catch up” in the currently open accounting period upon generation.