Are You Ready for the New Revenue Recognition Standards?

Part one of the six-part blog series

On May 28, 2014, FASB and IASB jointly issued ASC 606, Revenue From Contracts With Customers. The new standard will significantly affect many companies’ current revenue recognition practices.

Depending upon the business’ current model and revenue recognition practices, this standard could have a significant impact on the amount and timing of revenue recognition, which in turn, will impact key performance measures and debt covenant ratios and may even change the way the company looks at capital investment and compensation.

A few clarifications have been issued subsequently via Supplemental Updates: ASU 2014-09 regarding the effective dates of the new standard. The new measures are effective for public entities and some non-profit companies for the first interim period within the annual reporting periods beginning after December 15, 2017. Non-public entities have an additional year, starting with interim periods within annual reporting periods after December 15, 2018.

The whole intention here is to standardize revenue recognition practices across industries, as existing methods fall short regarding how value is delivered to the client based on obligations explicitly or implicitly specified in contracts.

These changes are only a few quarters away. Are you ready?

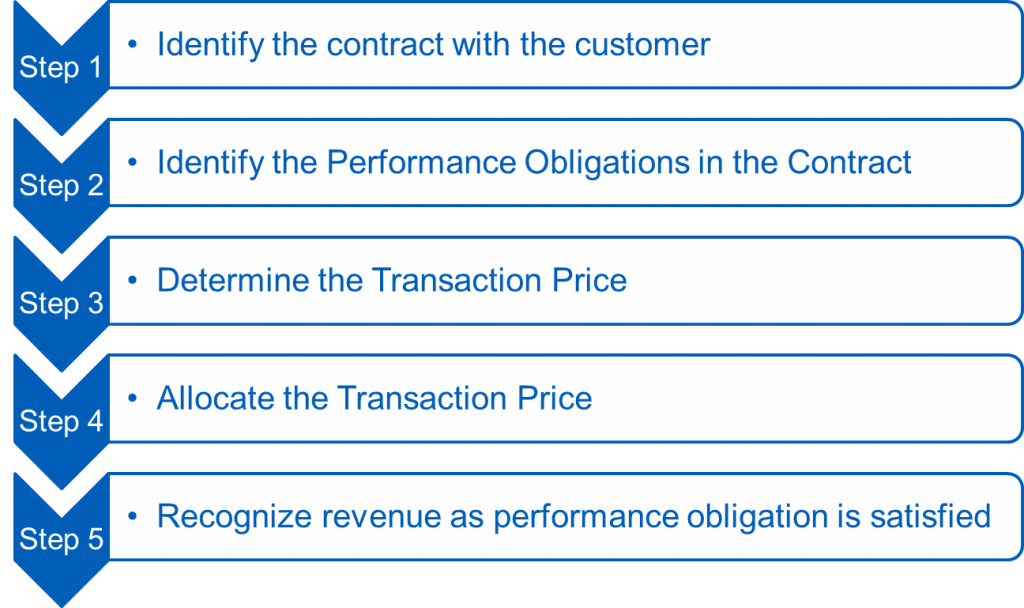

The core principle in the converged standard requires that an entity recognize revenue to depict the transfer of promised goods or services to a customer in an amount that reflects the consideration in exchange for those goods and services. To accomplish this goal, a five-step process has been outlined in the new standard. Every contract with a customer should be analyzed using these five steps to afford accurate reporting.

Five Steps to Revenue Recognition

There are specific rules defined for each of these steps. Follow our blog series for a deep dive into the five required steps.

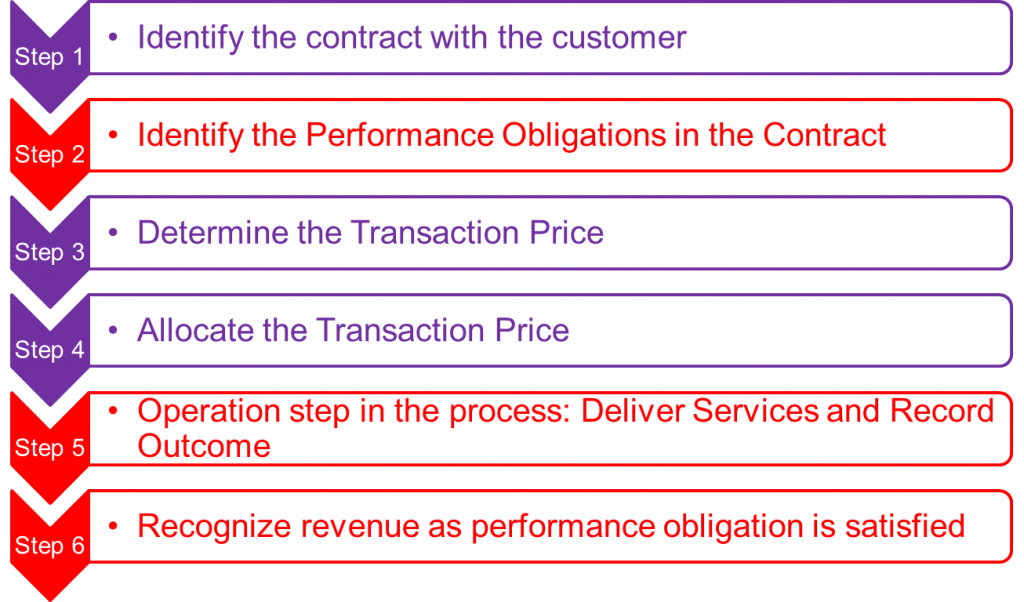

Mapping the New Standard to Oracle EBS Projects

The following diagram shows how the five steps above map to Oracle E-Business Suite (EBS) Projects. The Purple colored steps need the determination to be made by the business based on the contract. The roles involved in this determination include Finance, Legal, Contract Administration, and Project Managers.

An additional step (between the initial steps 4 and 5) has been added to the overall process that discusses the delivery of services and recording completion of the performance obligations identified before final revenue recognition can occur.

Contract Types

To better understand each of the steps shown above, let’s take into consideration three types of contracts typical to service delivery organizations:

Service Contracts based on selling hours (Time & Expense-“T&E”): In this scenario, the delivery organization contracts to provide a specified number of hours of specialized resources, which will deliver to the client’s requirements. There are no specific deliverables listed in the contract. These contracts are slowly disappearing as clients demand more specifics before signing contracts.

- Pure Professional Service Organizations (“PSO”) – Management Consulting

Time & Material (“T&M”) Service Contracts based on specific Deliverables AND Fixed Price Service Contracts based on Milestones: These are very typical service contracts. They are combined here even though they have completely different billing methods because they will need to be treated the same for revenue recognition purposes under the new standard. Additional contract types like Cost Plus or some variant of this with different fees will also fall under this category for Revenue Recognition as long as these contracts specify specific obligations/deliverables on the service provider.

- PSOs, Engineering, IT Services, Marketing/Advt. Services

Unit Price-Based Contracts: Commonly referred to as Schedule of Values (SOV) contracts. These contracts typically specify the number of units to be delivered for one or more types of items after an initial design/confirmation period.

- Construction, ATO/ETO-based Manufacturing Firms.

- SOV functionality is introduced in release 12.2.5

Our New Revenue Recognition Standards blog series demonstrates how project-centric companies can use Oracle EBS Projects to manage and comply with the new standards with minimum disruption to existing business practices. A case study for each contract type will explain how each step can be interpreted and implemented within Oracle EBS Projects Applications.

Up Next – Step 1: Identify the Contract with the Customer – Revenue Recognition Standards

Learn more on managing ASC 606 revenue recognition with Oracle EBS Projects-

Read the white paper

View the presentation

Questions?

Contact Us!