Costing Standard Rates vs. Actual Rates in Oracle Fusion

Oracle Fusion Projects Portfolio Management (PPM) will cost labor transactions at a standard rate setup in the rate schedules. For example, the rate could be at the person, job, or resource class level.

Oracle Fusion Payroll will cost labor transactions at an actual rate setup for the employee.

Assumptions that detail the example:

- Actual salary $100 / pay period + $30 for Benefits

- Employee charges 50/50 of time to direct/indirect

- Standard Costing rate 120 & 30% for benefits applied as a burden

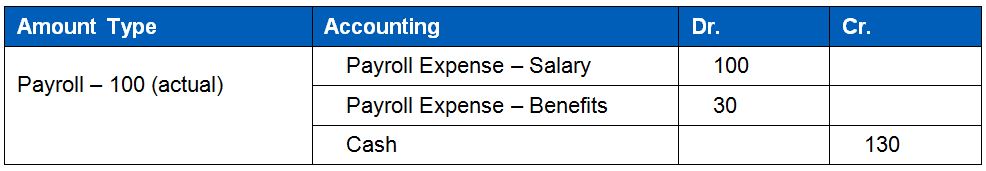

The Payroll Transactions (Actual Costs)

The payroll transaction will be processed directly into the GL and will not pass through PPM. There is no way to easily split the transactions across natural accounts for Direct & Indirect charges. It will only transfer the salary and benefits transactions into separate realistic accounts and look like the following:

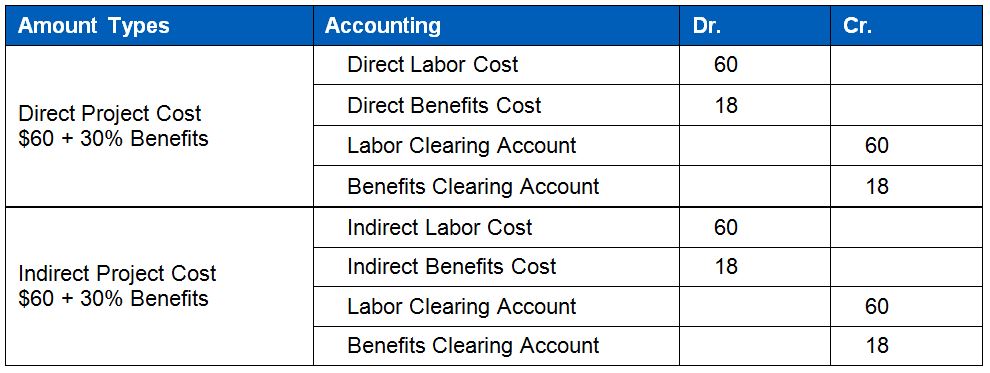

The Project Portfolio Management Transactions (Standard Rate Costs)

The PPM transactions will also process directly into the GL and will not pass into Payroll. PPM will split the transactions into Direct & Indirect costs. If burden schedules are set up correctly, they will also separate the benefits & other overhead costs.

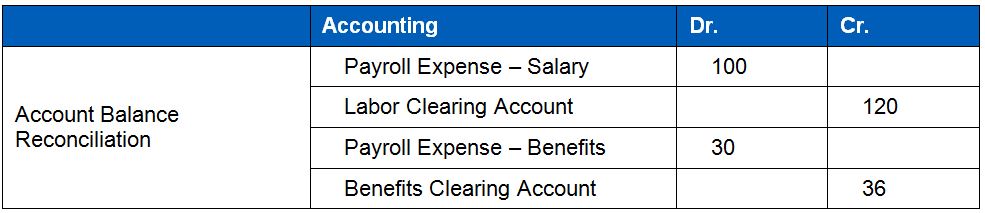

Balance Review When Closing the Period

Based on the above transactions, a few balances need to be reviewed and reconciled at the end of the period.

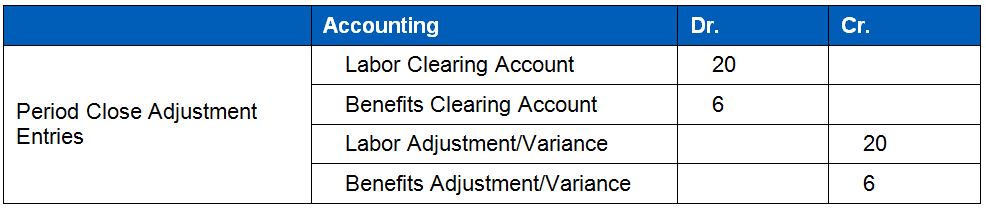

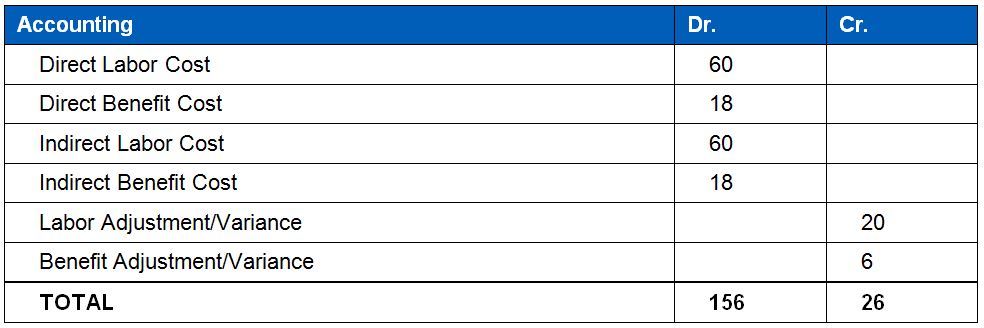

An entry is needed at the end of the period to adjust the payroll variance and report accurately. The labor variance measures the actual and expected cost of labor.

Financial Reporting

Finally, the financial report balances should include the variance account. The table below shows the credits and will net to the $130 from Payroll in our example:

If the rates are maintained accurately and regularly, the variances should remain small.

If the Labor Variance is favorable, the company pays less than its standard cost for its direct labor.

If the Labor Variance is unfavorable, the company pays more than its standard cost for its direct labor.

If there is a significant difference, in either case, the standard labor rates or the burden rates need to be reviewed and updated.

The Labor Variance accounts and the indirect labor cost accounts roll up to a summary indirect cost account, which is reported below the line in the P&L to derive net margins.

Questions? Contact us!

Project Partners has the experience to help you achieve the full potential of your Oracle Fusion Applications.