This blog is part of a series where we examine the impacts of ASC 606, Revenue from Contracts with Customers, and introduce the use of Oracle Projects to facilitate compliance with the new revenue recognition standards and five-step process.

Previous posts in our revenue recognition blog series include Introduction to Achieving ASC 606 Compliance, Step 1: Identify the Contract with the Customer, Step 2: Identify Performance Obligations in the Contract, Step 3: Determine the Transaction Price – Revenue Recognition Standards, and Step 4: Allocate the Transaction Price.

Deliver Services and Record Outcome

The final step required for recognizing revenue is Step 5: Recognize Revenue as Performance Obligation is Satisfied. In this blog, we will review an additional step about the delivery of services and recording completion of the performance obligations identified that must be addressed before final revenue recognition can occur.

A performance obligation is satisfied when or as control of the good or service is transferred to a customer. The Standard defines control as “the ability to direct the use of and obtain substantially all of the remaining benefits from the asset.” (ASC 606-10-20).

Performance obligations are fulfilled at a point in time when that obligation is satisfied. For performance obligations that are satisfied over time, the entity must decide how to appropriately measure the progress and completion of the performance obligation.

The following issues should be considered when applying Step 5 of the Standard:

Performance Obligation Satisfied Over Time

Entities are required to determine whether each performance obligation in a contract is satisfied over time. Any obligations not completed over time are assumed to be satisfied at a point in time. To be considered “over time”, the following criteria need to be met:

- The customer simultaneously receives and consumes the benefit provided by the entity as the entity performs.

- The entity’s performance enhances or creates assets that the customer controls while the assets are being enhanced or created.

- The performance does not create an asset with an alternative use to the entity, and the entity has an enforceable right to payment for performance completed to date (ASC 606-10-25:27).

Transfer of Control

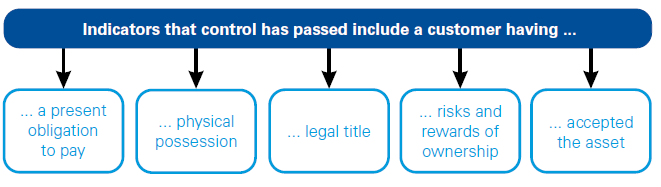

An entity must determine when control is transferred to the customer to determine when revenue should be recognized. The Standard provides several examples of indicators that the transfer of control has occurred, and these should be considered when determining when to recognize revenue.

Input vs. Output Methods

Entities can use either the input or output measure when satisfaction of a performance obligation occurs, whichever is the better indicator. The output method measures progress by results achieved, such as miles of electrical distribution lines completed. The input method measures progress based on the materials consumed, such as the feet of the electrical cable used. The Standard prefers the output method as it tends to better reflect the transfer of goods and services to the customer. However, if an alternative method better represents the transfer of goods and services, the Standard will allow its use. (For more in-depth information on revenue recognition methods, please refer to Input vs. Output Methods for Measuring Progress below.)

Stand-Ready Obligations

Promises by an entity to stand ready to perform a service or transfer a good can sometimes constitute a performance obligation. The entity will need to determine the appropriate method to recognize revenue.

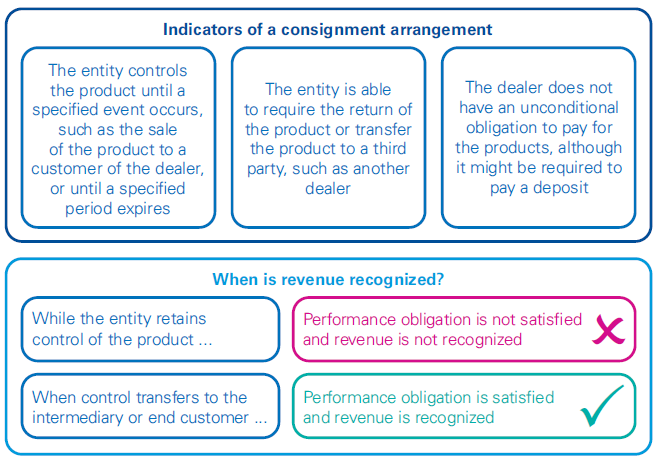

Consignment Arrangements

Revenue should not be recognized until control is transferred from the company to either the intermediary or to a customer through the intermediary.

Bill and Hold Arrangements

Unlike consignments, the customer has purchased goods from a company and requested that the entity hold the goods until the customer is ready to receive them. The Standard has simplified the prior criteria for when revenue is to be recognized under this arrangement. Still, the result is expected to be the same for most transactions.

Input vs. Output Methods for Measuring Progress

Output Methods

One of two methods for measuring progress, the output method, “recognizes revenue based on direct measurements of the value to the customer of goods or services transferred to date, relative to the remaining goods or services promised under the contract” (ASC 606-10-55-17).

Outputs are the result of inputs and processes of a business and are goods or services finished and transferred to the customer. The output method measures the results achieved. Surveys, appraisals, milestones reached, and units produced or delivered are all examples of output methods. Value to the customer is the objective measure of an entity’s performance.

The Boards decided that, at least conceptually, an output measure is the best depiction of the entity’s performance because it directly measures the value transferred to the customer. Although the Boards did not state that the output method is the preferred method, they felt that, in most cases, it is the most appropriate method that is consistent with recognizing revenue as value is transferred to the customer. A drawback to this method is that there may not always be a directly observable output to measure progress reliably.

Units-of-production or units-of-delivery methods may not be appropriate in contracts that provide design and production services as the transfer of produced items may not correspond to the actual progress made on the entire contract. To determine if these methods are acceptable, the entity should carefully consider all the facts and circumstances of the arrangement and how value is transferred to the customer.

Examples of an output method would include the number of feet of pipe used for a specific distribution project or the number of electrical poles used from a transmission plant to a final destination.

Practical Expedient for Measuring Progress

The Standard provides a unique output method of revenue recognition called a “practical expedient.” A practical expedient can be applied to performance obligations that meet the criteria in Step 5 for obligations satisfied over time. This measure is commonly referred to as the “invoice practical expedient” since it allows an entity to recognize revenue in the same amount to which the entity is entitled to invoice to the customer when that invoice amount directly corresponds to the value transferred to the customer. The practical expedient cannot be applied if this requirement is not met. In addition, the practical expedient can only be applied to performance obligations satisfied over time, not at a point in time. An example would be a service contract in which an entity bills a fixed amount for each hour of service provided.

In the case where the unit price varies during the contract period or a contract where the rate varies during the contract period, the practice expedient can be used as the changes reflect the value to the customer of each incremental good or service.

Input Method

“Input methods recognize revenue based on the entity’s efforts or inputs to the satisfaction of a performance obligation relative to the total expected inputs to the satisfaction of that performance obligation.” (ASC 606-10-55-20)

The input method is a more indirect measure of satisfying a performance obligation. Inputs are measured by determining the effort put into completing the contract. The input method is implemented by estimating the inputs required to satisfy a performance obligation and then comparing the effort expended to date against that estimate. Examples of input methods would be cost-to-cost, labor hours, or material quantities.

When choosing the input method for revenue recognition, there are several issues the entity needs to consider.

Inefficiencies and Wasted Materials

Even though an entity may decide that the input method is the most appropriate method to measure progress, there may be times when inefficiencies or wasted materials do not contribute to the satisfaction of the performance obligation. Abnormal waste costs do not represent additional progress toward completing an entity’s performance obligation and, if revenue is recognized over time, should be excluded from measuring such progress. If the entity uses costs incurred to date as an input method, it should ensure that revenue is not increased to offset the additional costs incurred when abnormal or excessive costs arise from inefficiency or error.

Uninstalled Materials

One of the problems with the input method is that the correlation between the inputs and the transfer of control of a good or service to the customer may not have a direct relationship. A customer may significantly obtain control of the good before receiving services related to the good. For example, a piece of equipment for which the entity is also providing installation may be transferred to the customer before installation. In this instance, the equipment and installation are the overall projects provided to the customer. Since it may be difficult for the entity to determine the amount of revenue to recognize for the delivery of the equipment, and since the equipment is no longer a part of the entity’s inventory, the Boards have deemed it appropriate to only recognize revenue in the amount of the cost of the equipment transferred and not include any amount of profit margin (a cost-to-cost measure of progress).

As you can see, Oracle Projects allows you to configure your projects to meet the requirements of Step 5 of the new ASC 606 guideline using standard functionality. The next blog in the series will cover Step 5b: Recognize Revenue as Performance Obligation is Satisfied – Methods to Properly Measuring Progress.

Oracle Licensing Requirements:

- Project Costing and Billing is required for all features discussed in this paper

- Project Planning and Control must be implemented to leverage Deliverable functionality

- Schedule of Values functions are available in Oracle Project Planning and Control release 12.2.5

Learn more on managing ASC 606 revenue recognition with Oracle E-Business Suite (EBS) Projects –

Read the white paper

View the presentation

Questions?

Contact Us!