This blog is part of a series where we examine the impacts of ASC 606, Revenue from Contracts with Customers, and introduce the use of Oracle Projects to facilitate compliance with the new revenue recognition standards and five-step process.

Previous posts in our revenue recognition blog series include Introduction to Achieving ASC 606 Compliance, Step 1: Identify the Contract with the Customer, Step 2: Identify Performance Obligations in the Contract, Step 3: Determine the Transaction Price – Revenue Recognition Standards, Step 4: Allocate the Transaction Price, and Step 5 (Part One): Recognize Revenue as Performance Obligation is Satisfied.

In part one of Step 5, we discussed the various items that must be considered for Compliance. One of the key concepts discussed was the determination of Input and Output Progress Methods to correctly record the outcome of service delivery. To conclude the discussion on Step 5, we will discuss the methods for adequately measuring progress so that outcome is accurately recorded and provide case studies for the various methods of progress measurement.

Methods for Measuring Progress

After determining that a performance obligation is satisfied over time, an entity must determine how far complete the entity’s progress is at any given reporting period. This is referred to in the new Standard as a Measure of Progress.

For example, if a calendar year reporting entity enters into a software support agreement for 12 months beginning on January 1, there are three ways an entity can measure progress:

- Based upon costs incurred, which is the physical percent complete of costs incurred to the total expected costs of the contract.

- Based on labor hours, the number of hours incurred each month is a percentage of the total hours estimated for the year.

- Based on time elapsed – where the revenue is generated as 1/12 of the total contract value each month.

The object when measuring progress is to depict an entity’s performance in transferring control of goods or services promised to the customer. (ASC 606-10-25-31)

Selecting a Method to Measure Progress

When performance obligations are satisfied over time, an entity must determine a single method of measuring progress toward the completed satisfaction of the obligation. The objective is to transfer control of the goods or services to the customer. To accomplish this, the entity selects either the output or input method and applies it consistently to similar performance obligations. Both methods are acceptable under the new standard but are not interchangeable.

The method used must be appropriate for the circumstances of the contract, as it can result in material differences in the timing of revenue recognition. Careful determination of which method best reflects the substance of the contract should be considered.

The Output method is based on the direct measurement of the value of the goods or services transferred to date relative to the other goods or services promised under the contract. In Oracle Projects, these measurements are Physical Percent Complete, Milestones and Schedule of Values, and Deliverables.

The Input method is based upon the entity’s efforts toward satisfying a performance obligation relative to the total expected input to satisfying that performance obligation. In Oracle Projects, these measurements are called Cost to Cost Revenue and Time and Materials.

The Standard allows an entity, in particular contracts, with the right to bill an amount for each unit of service provided to recognize revenue for the amount being billed. This is referred to in the Standard as a “practical expedient.” In this instance, the entity has the right to invoice a customer at an amount equal to its performance. This amount does not need to reflect the fixed amount per unit for this to be applied. The invoiced amount should directly correspond to the value transferred to the customer.

If an entity’s inputs are incurred evenly over time, then it may be appropriate to recognize revenue on a straight-line basis (for example, in the case of a 1-year fixed-amount contract).

Determining which measure of progress to apply is not a free choice.

An entity needs to exercise judgment in identifying a method that fulfills the stated object of the new standard. The Standard requires the entity to select a method that depicts its performance. The entity needs to consider the nature of the good or service it promised to transfer to the customer.

Examples are given within the standard circumstances where a particular method does not necessarily depict performance. (Units of production may not be appropriate where there is a material amount of work in progress.) In addition, an entity must be able to apply a method that is both reliable and relevant. If the information used to apply the output method is not directly observable or would require a large cost to obtain, then the input method may be appropriate. In these cases, judgment is required to identify the appropriate method.

Neither method is preferred over the other since both methods have advantages and disadvantages that make them more or less appropriate to the facts and circumstances of the contract. While the output method is generally preferable, a measure of output may not always be directly observable or provide an appropriate measure of performance. While the new standard does not prescribe which method to use, the entity should select an approach that depicts its performance in transferring control of goods and services promised to a customer.

Single Measure of Progress

Significant judgment and understanding of the nature of the promise to the customer is key to selecting a reasonable measure of progress. The new Standard requires a single method of measuring progress for each performance obligation. This may not be easy if multiple performance obligations are to be transferred to the customer over time.

The entity needs to consider assessing performance obligations and whether there are multiple distinct obligations or a single obligation. Using multiple methods of measuring progress for the same performance obligation is inappropriate. Therefore, for a single performance obligation, regardless of the number of goods or services and payment streams, the entity must identify a single measure of progress that appropriately depicts its progress toward complete satisfaction of that performance obligation.

Should it prove difficult to identify a single measure of progress that accurately determines progress toward satisfaction due to the number of goods and services that make up the performance obligation, the entity may need to reassess the performance obligations identified in the contract to see if there are more performance obligations than initially identified. If so, each performance obligation can be taken on its merit when determining the appropriate method for revenue recognition.

In addition, when determining the appropriate method for measuring progress, an entity should be aware that the standard requires them to apply the same method to all similar performance obligations in similar circumstances.

Subsequent Measurement of Measure of Progress

Since estimates of an entity’s level of progress will change as the performance obligation is fulfilled, such estimates should be updated with the most current information available. Changes in estimates should be accounted for in a manner consistent with the guidance on accounting changes which states that changes in accounting estimates shall be accounted for in the period affected by the change and in future periods if the change affects both. This does not refer to a change in scope or price but rather a change in an accounting estimate, so the new revenue standards for contract modifications would not apply.

For example, A company contracts for a fixed price of $2,000,000, and the entity concludes that a cost-to-cost revenue approach should be used for revenue recognition. To date, costs incurred total $450,000, with a cost estimate of $900,000. If the total cost estimate is dropped to $800,000, the revenue would need to be adjusted to reflect the new estimate, as shown here:

- Revenue recognized to date = ($450K/$900K) * $2M = $1M

- Adjusted revenue based on new estimate = ($450K/$900K) * $2M = $1.125M

- Increase in revenue recognized due to change in estimate = $125K.

Oracle Projects functionality allows for the automatic recalculation of recognized revenue. Oracle Projects posts the change to the total to be recognized ($125K) in the current accounting period. In addition, future revenue streams are calculated using the new accounting estimate per the new Standards requirements.

Reasonable Measure of Progress

In some circumstances, an entity may not be able to reasonably measure progress toward completion as it lacks the reliable information required to apply an appropriate method of measuring progress (such as a long-term contract). In some circumstances, an entity may not be able to reasonably measure progress but expects to recover the costs incurred in satisfying the performance obligation.

In those instances, the entity should recognize revenue for its progress by recognizing revenue solely in the amount of the costs incurred. This will result in a net margin of zero. This would only be appropriate until the entity can reasonably measure progress or until the performance obligation becomes too arduous.

When the new revenue standard was being developed, the Board used legacy GAAP and measures of progress used in current practice. Two measures of progress were carried forward in the new standard and will be addressed in detail in a future release in this series.

Comparison of ASC 606 to ASC 605

The key differences between the prior methodology and the new revenue recognition standard revolve around Scope, Timing and Control, and Control vs. Risks and Rewards of Ownership.

Scope

The old standard consisted of industry-specific guidance. The new standard consolidates revenue guidance across most industries, meaning that all entities with performance obligations satisfied over time must select the revenue recognition method that best depicts performance measures in transferring goods and services to their customers.

Timing and Control

The new standard outlines three criteria that improve the distinction between contracts that are satisfied over time and those that are satisfied at a point in time. To be considered “over time,” the following criteria need to be met:

- The customer simultaneously receives and consumes the benefit provided by the entity as the entity performs.

- The entity’s performance enhances or creates assets that the customer controls while the assets are being enhanced/created.

- The performance does not create an asset with an alternative use to the entity, and the entity has an enforceable right to payment for performance completed to date (ASC 606-10-25:27).

Companies will need to rethink how they recognize revenue depending upon the criteria laid out in the new standard.

Companies that utilized the straight-line method of revenue recognition under the old standard must now choose a method and put in a process to track progress using the chosen method going forward. Entities must follow the method that best depicts performance in transferring goods or services, making accounting for contracts more complex. Reevaluation of the timing of revenue recognition with customers may be necessary.

Control vs. Risks and Rewards of Ownership

The vital issue for revenue recognition is determining exactly when the goods or services are transferred to the customer. The new standard shifts the focus from the “risks and rewards of ownership” to assessing whether the control has been passed to the customer (ASC 606-10-25-25). This may affect the timing of revenue recognition.

Under the old standard, only construction and production-type contracts utilized the input and output methods. All performance obligations satisfied over time, regardless of industry, must use the input and output methods. The differences between these two methods can result in material differences in revenue being recognized. Objective judgment is required in deciding which method to apply.

Using Oracle Projects to Meet the Objectives Of Step 5 of ASC 606

Case Studies

In our previous blogs on ASC 606 Revenue Recognition, we described three types of contracts typical to service delivery organizations:

- Service Contracts based on selling hours (Time & Expense-“T&E”): In this scenario, the delivery organization contracts to provide a specified number of hours of specialized resources to meet the client’s requirements. There are no specific deliverables listed in the contract. These contracts are slowly disappearing as clients demand more specifics before signing contracts.

- Pure Professional Service Organizations (“PSO”) – Management Consulting

- Time & Material (“T&M”) Service Contracts based on specific Deliverables AND Fixed Price Service Contracts based on Milestones: These are very typical service contracts. They are combined here even though they have completely different billing methods because they will need to be treated the same for revenue recognition purposes under the new standard. Additional contract types, such as Cost Plus or some variant of this with different fees, will also fall under this category for Revenue Recognition as long as these contracts all specify obligations or deliverables on the service provider.

- PSOs, Engineering, IT Services, Marketing/Advt. Services

- Unit Price-Based Contracts: Commonly referred to as Schedule of Values (SOV) contracts. These contracts typically specify number of units to be delivered for one or more types of items after an initial design/confirmation period.

- Construction, ATO/ETO-based Manufacturing Firms.

- The schedule of Values functionality is delivered in release 12.2.5

We will continue to Step 5 using the case studies previously discussed.

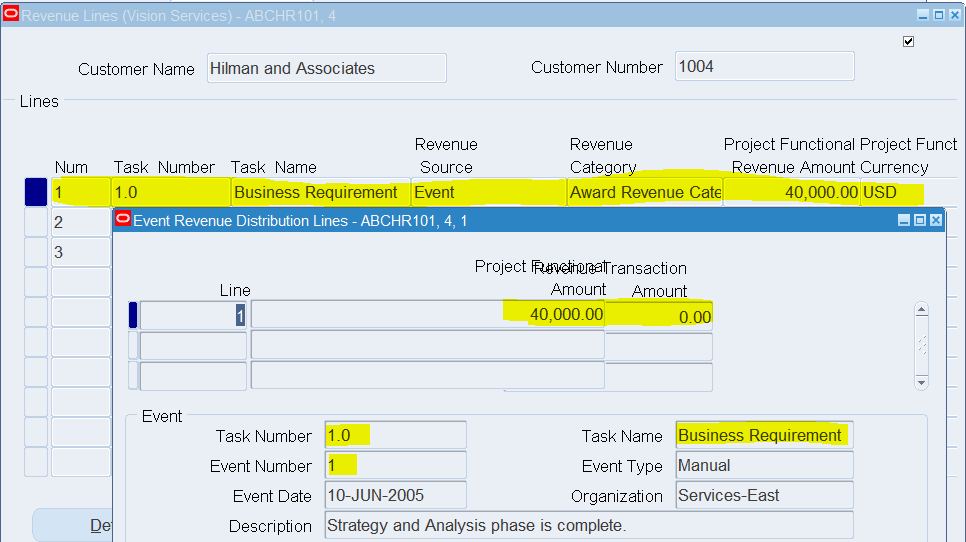

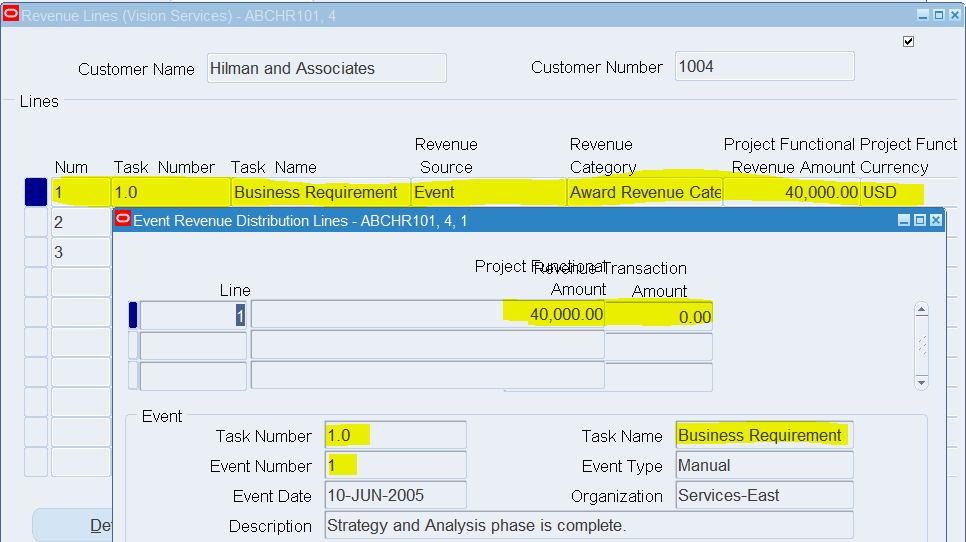

In Oracle Projects, Step 5 of the Standard requires a two-step approach. Work is performed, and delivery is recorded in Oracle Projects. Then, a process to Generate Draft Revenue for the projects is run to complete the recognition process.

Service Contracts based on selling hours (T&E)

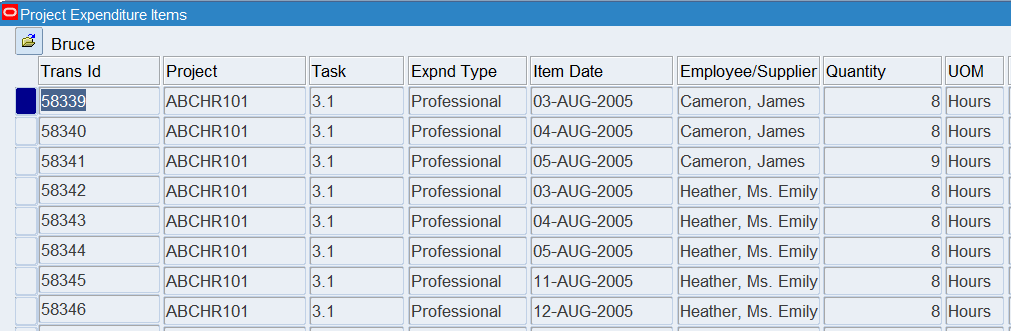

- Delivery Team Charges Time & Expenses to the Project

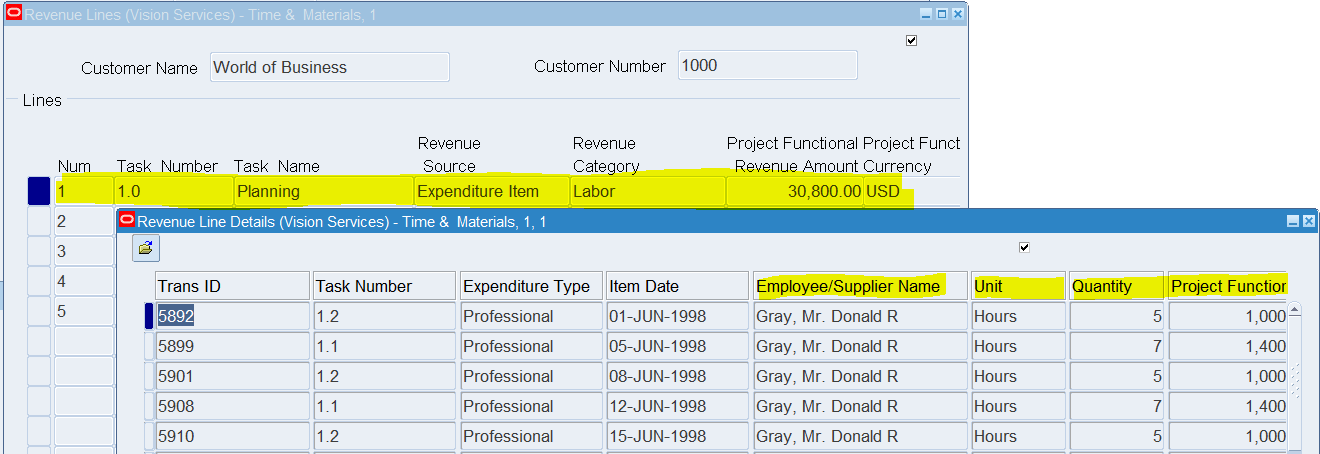

Run the Generate Draft Revenue Process for your projects to recognize revenue:

- Service Contracts based on selling hours (T&E)

- Revenue based on hours charged

Perform Work and Record Delivery

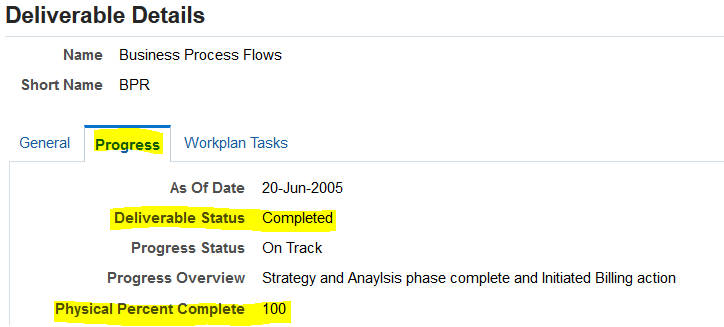

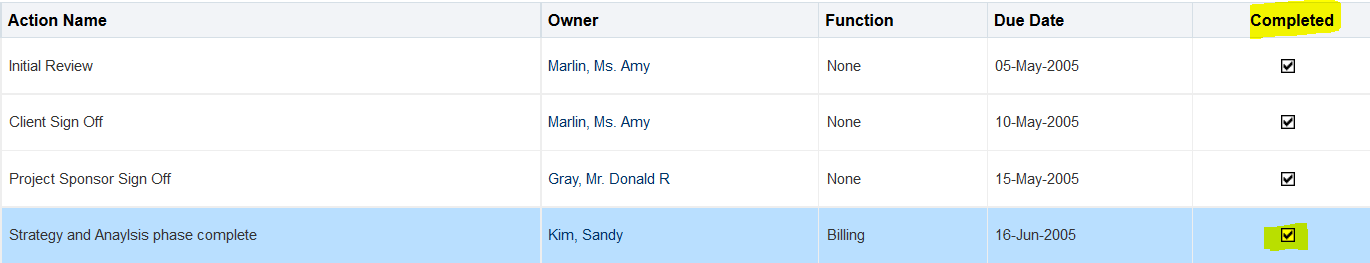

T&M Service Contracts based on specific Deliverables and Fixed Price Service Contracts based on Milestones

- Mark the Deliverable As Complete. Mark Billing Action as Complete

Run the Generate Draft Revenue Process for your projects to recognize revenue:

- T&M/Fixed Price Service Contracts

- Billing Events Generated from Deliverables are used to generate Revenue

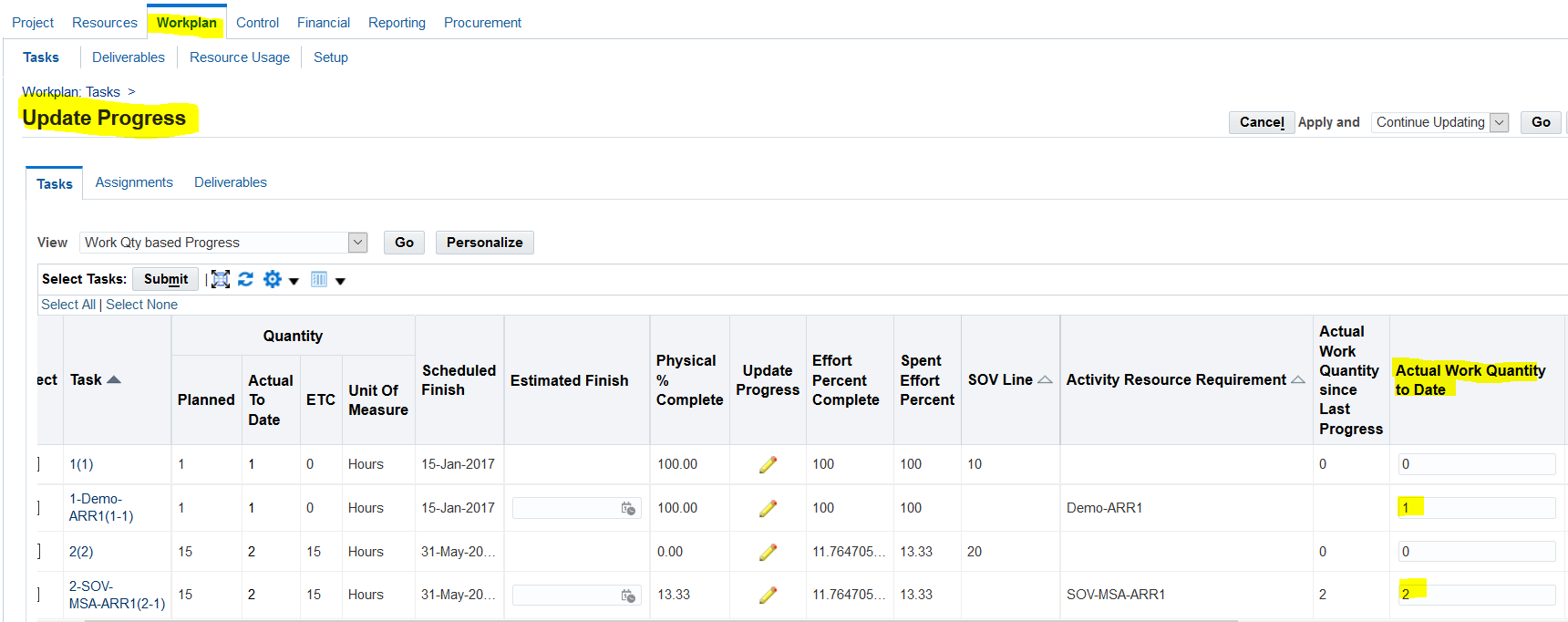

Unit Price-Based Contracts

- Enter Progress and record Quantity completed for each SOV Task

Run the Generate Draft Revenue Process for your projects to recognize revenue:

Unit Price-Based Contracts

- Billing Events Generated from SOV Progress are used to generate Revenue.

As you can see, Oracle Projects allows you to configure your projects to meet the requirements of Step 5 of the new ASC 606 guideline with standard functionality. In the next blog in the series, we will cover Contract Modifications.

Oracle Licensing Requirements

- Project Costing and Billing are required for all features discussed in this paper.

- Project Planning and Control must be implemented to leverage Deliverable functionality.

- Schedule of Values functions are available in Oracle Project Planning and Control release 12.2.5

Learn more on managing ASC 606 revenue recognition with Oracle E-Business Suite (EBS) Projects –

Read the white paper

View the presentation

Questions?

Contact Us!